Every day, you find a new DeFi (Decentralized Finance) product getting funded, built upon blockchain networks such as Ethereum. And what do they intend to achieve? Cryptocurrencies are here to disrupt existing centralized financial structures. They are here to fundamentally alter the way we transact value. And how do they do it? By making finance accessible to anyone—through decentralization—there is no central body controlling the movement of value. These DeFi applications let you do either or all of them: lend cryptos & earn interest, invest in cryptos & earn returns, or earn incentives by taking part in the governance of these cryptocurrencies. I am not going to go deep into how these applications work. You want a long story short, DeFi applications disrupt the way we move money.

By introducing

- new monies (Bitcoin, Ethereum)

- new process/protocols to transact

But these cryptocurrencies did more than challenge money!

They introduced something called tokens. One type of token is called non-fungible and the other is fungible. The difference is something you ought to know. The fungible tokens are what we witness in decentralized finance. These tokens enable fractional ownership. For example, you can even buy 0.01 of Ethereum and exchange it with another currency of proportionate value. The same goes with Bitcoin, or Uniswap, etc. The other type of token is non-fractionalized, and they represent real-world assets. The NFTs, as they are called, are digital assets representing real-world physical items such as music, real estate, painting, diamonds, whatever is tangible and have an inherent/perceived value in it.

So, what happens when you tokenize real-world assets?

It means you can freely move it. These assets need not be frozen or locked anymore. You can exchange and transact faster without an intermediary because you are doing all of this on a blockchain network, which makes the transaction immutable, secure, and transparent.

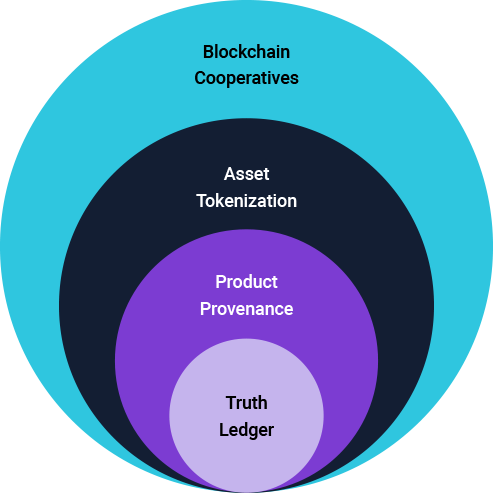

So, blockchains disrupt not just money and its movement but also initiate the tokenization of assets. However, it will be a few years before real assets get exchanged on blockchains. The blockchain evolution will happen in circles. See the Fig below.

Read the white paper here: Circles of Trust: A compelling use-case model for enterprise blockchain adoption

While you see DeFi applications taking the consumer world by storm, the B2B segments will cautiously tread with blockchains. The enterprises may need third parties to help them adopt blockchain. The role of blockchain as a service (BaaS) companies will be significant as they will play a crucial role in the success of enterprise blockchains. Blockedge is one such company that launched its plug & play blockchain-as-a-service platform for automotive and supply chain segments.

But what applications would see success at the enterprise level?

Remember, in the consumer world, blockchain experimentation revolves around the storage and exchange of cryptocurrencies. In the enterprise world, instead of currencies, it will be about information. Blockchains will be used to store and share immutable information. The base application would be an immutable truth ledger upon which numerous use cases could be realized. For example, you could create an un-alterable patient recordkeeping solution. The health information resides on an immutable ledger, through which doctors and patients can access the patient information securely.

You could also enable automated warranty claims or insurance based on smart contracts. Smart contracts are coded contracts that enable automated transactions if certain conditions are triggered.

For example, if a warranty claim obeys the conditions written as a smart contract, on the blockchain, then the transaction can be automated. At a time when 2/3 of the warranty costs go towards administration and processing costs, blockchain-enabled warranty systems promise to bring significant cost savings owing to a reduction in document verification time, fraudulent claims, and warranty mismatches.

Remember, in the consumer world, cryptocurrencies would establish first and then real-world assets will be tokenized and traded.

In the B2B segment, on one side, you have blockchain applications built for immutable information. Parallelly, we witness companies using the blockchain network to track and trace products along the supply chain in real-time. These track and trace dApps (decentralized applications) will help companies locate the exact position of a product in real-time. It can also verify the authenticity of a product’s origin. For example, Carrefour, a French supermarket chain tracks its farm-raised eggs and other 30 product lines. Customers with the use of a QR code can exactly locate the origins of these product items.

Highlights

So, this is how the blockchain world will evolve.

- Introducing consumers to blockchain through tokens

- Introducing enterprises to blockchain through dApps

Slowly the best of both worlds will converge, and a decentralized, tokenized economy will become the order of the day.

But before we enter a full-blown decentralized, tokenized economy, we must realize that blockchains are increasingly seen as a competitive weapon in markets such as automotive, supply chain, and healthcare. According to Gartner, 2021 is the year when enterprises would begin to have a grip on blockchain use cases. Consider this with the fact that the enterprise blockchain spending will touch $6B, up from 50% in 2020.

We are going to witness massive blockchain adoption in enterprises. But what applications will taste success, what problems do they solve, and what benefits would these bring. How much centralization/decentralization would require for these blockchain applications. The blog provides just a glimpse of how blockchain will influence the commercial markets. But you will find ready, in-depth insights about enterprise blockchain adoption in our handbook.

Remember most businesses would probably fail to identify or agree on the correct use case. Much of that is attributed to a superficial understanding of how enterprise blockchains would enable or suit one’s business. A lot of that is again answered in the Blockchain handbook.

So, we saw how cryptocurrencies would power the consumer markets, introduce them to tokens, before we move to tokenization of real assets and trading them on blockchains.

Whereas in the enterprise markets, we will witness healthy adoption across the globe. Most of which will center on operational improvements.

Both markets will mature and introduce decentralized autonomous organizations a.k.a blockchain cooperatives, which is again dealt with in detail in the handbook.

Stay tuned for more blockchain stories.

Joe Arputhan Writer, researcher, content marketing evangelist, and blockchain enthusiast. |